What do we know?

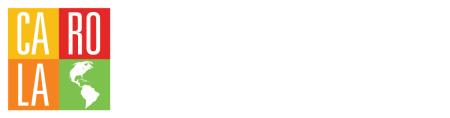

Status and Outcomes of Disputes

1190

32.06%

62%

59.32%

ISDS is asymmetrical by design. States cannot initiate proceedings against investors nor, for the most part, successfully assert counterclaims on the merits. This results from the fact that obligations are typically only construed in relation to the State. In this way, States pay investors both as a result of an award or upon settlement, but not vice versa.

65%

This last sum is 4 times the current health spending in Ecuador (USD 7.8 billion), close to almost 1/3 of Colombia’s 2022 national budget (USD 93 billion), and more than 1/2 of the total IMF bailout pledged to Argentina in 2018 (US$ 57 billion)

65.5%

79%

A Closer Look:

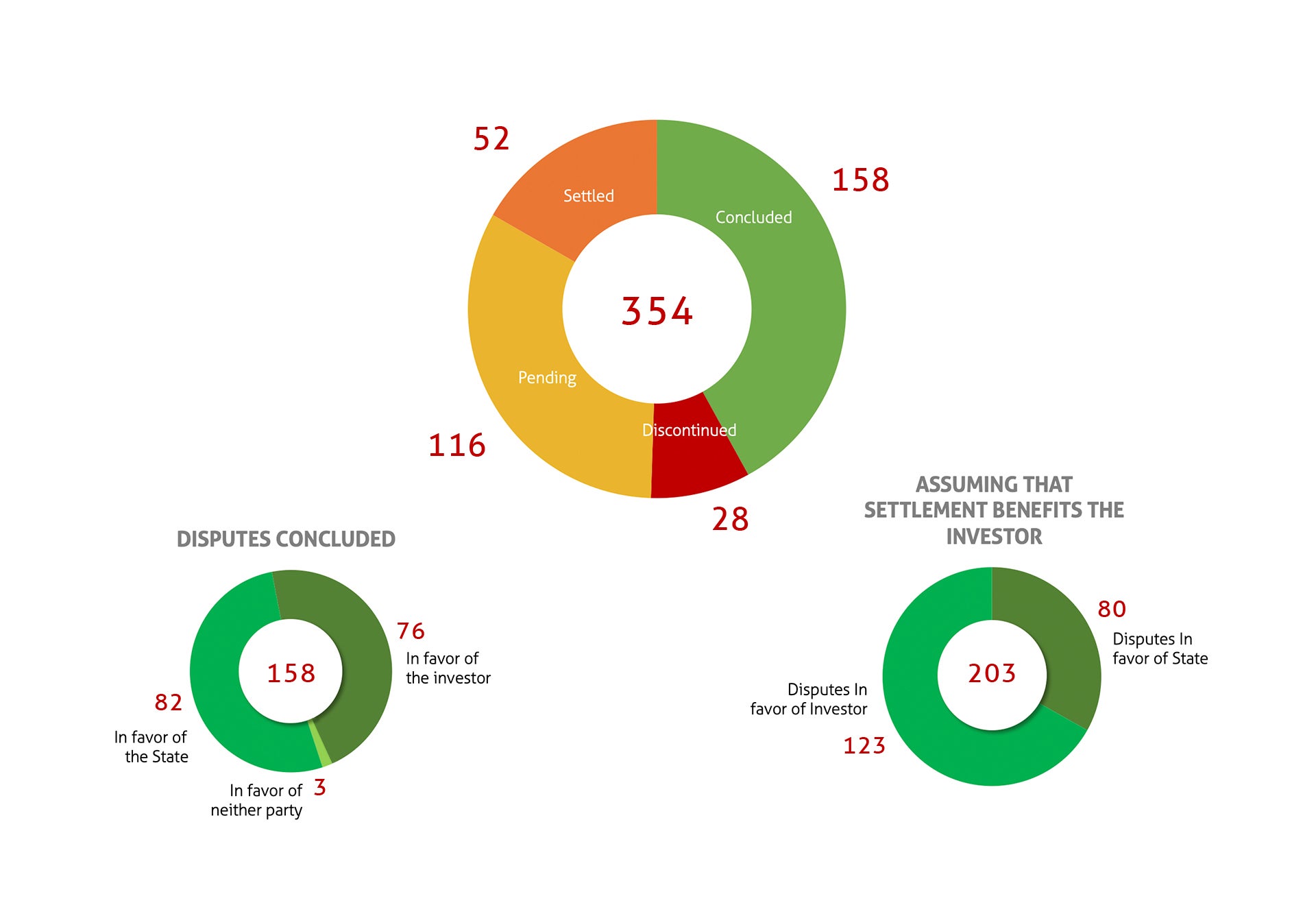

Since 1996, investors have sought recourse to ISDS in solving their differences with LAC countries. Investor-state disputes have been on the rise, with a boom taking place in 2003, largely due to the 2001 Argentinian financial crisis (20 of the 25 disputes of 2003 involve Argentina)

83.8%

Investment Regime Reform Alternatives

The escalation of disputes in recent years, the unpredictability of ISDS outcomes, the high dollar amount of awards and damages calculation, and the shift in claims from those that target direct takings to those challenging government regulation, on top of growing evidence of the disconnect between IIAs and FDI inflows, has led many to rethink the current approach to international investment ordering. In this Policy Brief, CAROLA identifies potential alternatives to international investment reform and indicates mechanisms through which these reforms may be implemented.